IRS Rakes in $8.4 Million from WSOP Main Event Final Table

On Tuesday, longtime PocketFiver Joseph dude904McKeehen earned $7.6 millionafter taking down the World Series of Poker Main Event for his first bracelet. While it was the largest sum of money earned by any single member of the November Nine, it wasn’t the largest payday given out. That distinction belongs to the US Internal Revenue Service, which according to Taxable Talkcollected $8.4 million out of the $24.8 million awarded at the final table, or 34%.

On Tuesday, longtime PocketFiver Joseph dude904McKeehen earned $7.6 millionafter taking down the World Series of Poker Main Event for his first bracelet. While it was the largest sum of money earned by any single member of the November Nine, it wasn’t the largest payday given out. That distinction belongs to the US Internal Revenue Service, which according to Taxable Talkcollected $8.4 million out of the $24.8 million awarded at the final table, or 34%.

Cue cash register sound effects.

Yes, some of these players were backed and there are definitely deductions to be had, but according to the site, “For finishing first out of 6,420 entrants, [McKeehen]won $7,683,346. As a professional poker player, he’ll owe self-employment tax along with his federal income tax ($3,073,240), Pennsylvania state income tax ($235,879), and the local township (North Wales Boro) Earned Income Tax ($76,833), a total of $3,385,952 (44.07%). He’ll get to keep an estimated $4,297,394 of his winnings.”

That’s a pretty good day for Uncle Sam, who didn’t have to win a coin flip or pick off a river bluff.

McKeehen (pictured), who is from Pennsylvania, beat out fellow PocketFiver Josh asdf26 Beckley, who earned $4.4 million for second place. Taxable Talk noted that Beckley is actually subject to more tax than his November Nine counterparts due to his New Jersey address: “His percentage tax burden is higher than the winners at 46.56%; that’s because New Jersey is decidedly not a low-tax state. Still, he’ll end up paying $2,081,719 in tax.”

McKeehen (pictured), who is from Pennsylvania, beat out fellow PocketFiver Josh asdf26 Beckley, who earned $4.4 million for second place. Taxable Talk noted that Beckley is actually subject to more tax than his November Nine counterparts due to his New Jersey address: “His percentage tax burden is higher than the winners at 46.56%; that’s because New Jersey is decidedly not a low-tax state. Still, he’ll end up paying $2,081,719 in tax.”

The highest tax liability by percentage goes to Federico Butteroni, who will be assessed a tax rate of 47.90% from the Italian Government, or a little over $500,000 of real money. Butteroni exited the Main Event in eighth place.

The real winner of the group was Pierre Neuville, who busted out in seventh place and took home $1.2 million. Why is he the big winner then? Spoiler: he owes no taxes to the US or to his native Belgium, according to Taxable Talk, which means he essentially gets off scot-free: “The US-Belgium Tax Treaty exempts gambling winnings from US taxation, so Neuville owes nothing to the IRS. Belgium doesn’t tax gambling winnings of amateur gamblers, so he owes nothing to Belgium.”

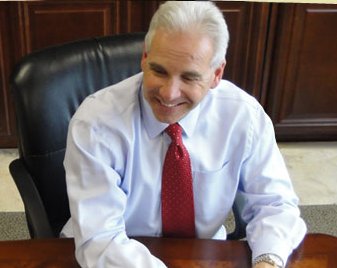

In an interview from earlier this yearon PocketFives, poker tax advisor Ray Kondler (pictured) from Kondler and Associates recommended that anyone with a sizable score, whether at the WSOP or elsewhere, contact a CPA for guidance: “If you are fortunate enough to hit a large score at any point during the year, the absolute first thing you should do is look for outside guidance. I would suggest consulting with a CPA and a financial advisor before you go to the cage to claim the money. It is important to outline all of the factors that will be affected by the win.”

In an interview from earlier this yearon PocketFives, poker tax advisor Ray Kondler (pictured) from Kondler and Associates recommended that anyone with a sizable score, whether at the WSOP or elsewhere, contact a CPA for guidance: “If you are fortunate enough to hit a large score at any point during the year, the absolute first thing you should do is look for outside guidance. I would suggest consulting with a CPA and a financial advisor before you go to the cage to claim the money. It is important to outline all of the factors that will be affected by the win.”

Kondler reacted to the tax estimates from Taxable Talk on Wednesday, telling PocketFives, “These are worst-case scenario figures that don’t take any deductions (losses for amateurs, losses and expenses for professionals) into account. Since we (or Russ Fox from Taxable Talk) don’t know how the players will file or how many deductions they will claim, it’s very hard to determine an actual amount paid for taxes.”

The 2015 WSOP certainly attracted a ton of poker talent from the United States and around the world, as 103,512 players from 111 countries participated, generating a total prize pool that lapped $210 million.

Want the latest poker headlines and interviews? Follow PocketFives on Twitterand Like PocketFives on Facebook.